The 5 Most Traded Currency Pairs in 2022

Contents

Agriculture – as well as international trade and tourism – is key to the New Zealand economy, so the price movements of soft commodities will often play out on NZD/USD. But – similar to the yen – the Swiss franc owes much of its popularity varalen capital markets status to a relatively stable currency. This has made the franc a popular currency in times of economic uncertainty or market turmoil, as traders seek markets that are perceived as less volatile – similar to the USD/JPY pair.

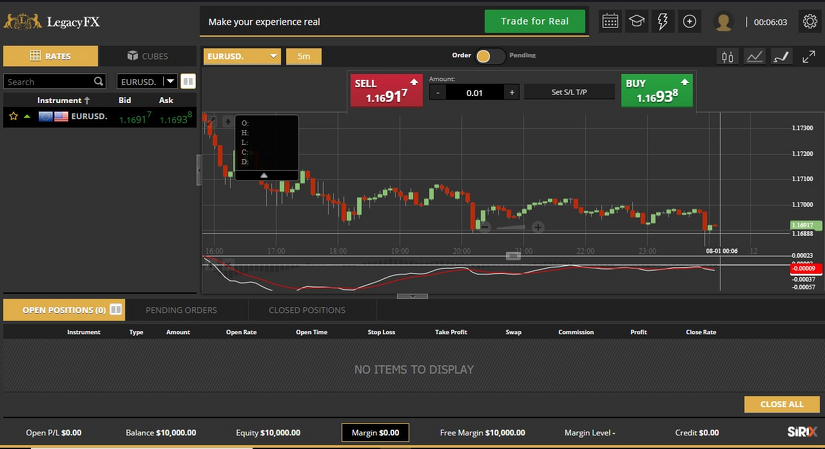

On the right, the price is falling as the euro declines in value relative to the US dollar. Currency prices are constantly changing—especially the majors since there are so many participants putting through orders every second—with the current rate shown via a currency quote. Due to their commodity-based economies, trading volumes in the USD/CAD, AUD/USD, and NZD/USD will often exceed those in the USD/CHF, and sometimes the GBP/USD. CFDs are leveraged products and as such loses may be more than the initial invested capital.

USD

The supply of US Dollars is controlled by the US central bank, the Federal Reserve. Although the US Dollar has been forecast to eventually surrender its dominant global position to the Euro, the US currency remains a safe haven in times of crisis and the key global reserve currency. When you trade Forex, you are anticipating that one currency will fall or rise relative to another currency.

Forex and CFDs are leveraged products and can result in losses that exceed your deposits. Each currency pair has a ‘base’ which is the first denoted currency, and a ‘counter’ which is the second denoted currency. Among the above trading strategies, choosing the best brokerage and trading platform is perhaps the most important.

It is recommended that those who trade this volatile currency pair strengthen their knowledge of technical analysis of the market before opening any positions. The foreign exchange rate of currency pairs for traders is affected by the fluctuating strength of the currencies. The global and central banks fx glory provide these rates and update them in real-time. They involve the currencies euro, US dollar, Japanese yen, pound sterling, Australian dollar, Canadian dollar, and the Swiss franc. The popular currency pairs that are made up of major currencies other than the US dollar are usually called cross pairs.

Difference Between The Bid And Ask PriceThe bid rate is the highest rate the prospective buyer is ready to pay for purchasing the security. In contrast, the ask rate is the lowest rate, the prospective seller of the stock is ready to sell the security. The bid is the price the dealer would pay for the currency, and the asking price is what they would be willing to sell it.

What Are the Most Commonly Traded Currency Pairs?

Open a live account to start trading straight away or practice first with virtual funds on our demo trading account. Get tight spreads, no hidden fees and access to 12,000 instruments. The USD/CHF is a safe haven currency which is where investors will put their money when the markets are extremely volatile and uncertain. Other2.2%Total200.0%The rules for formulating standard currency pair notations result from accepted priorities attributed to each currency. The products and services described herein may not be available in all countries and jurisdictions.

For those of y’all who are really mesmerized by exotics, here’s a more comprehensive list. Determine significant support and resistance levels with the help of pivot points. From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

“The Swissie” is a combination of the US dollar and the Swiss franc. For many years, the financial stability of Switzerland has been used as a ‘safe haven’ for investors of the forex market, who will rely on trading the CHF in times of market volatility. Therefore, this is a popular forex pair for traders when the economic or political situation of a region is uncertain.

When you combine a major currency with a minor currency , you get a minor currency pair. The United States dollar is the most commonly traded currency in the world, and therefore most major forex pairs include the USD as the base or quote currency. When combined with other currencies from some of the world’s biggest economies, including China, Japan and the United Kingdom, these are seen as major crosses. While the complete list of major currency pairs might differ from trader to trader, there are four major pairs that are not up for much debate.

Cory is an expert on stock, forex and futures price action trading strategies. XM sets high standards to its services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. Access the global markets instantly with the XM MT4 or MT5 trading platforms. Stay informed with real-time market insights, actionable trade ideas and professional guidance.

How to Trade Currency Pairs?

The most traded currencies in the world come from multiple continents and they belong to some of the strongest economies. These include major forex pairs, as well as “safe haven” currencies and those with historically stable trade links. This article is a guide to five of the most traded currency pairs on our platform. The currencies considered “major” are those most used in world trade and finance — the US dollar, UK pound, euro, and Japanese yen. Each of the currencies named in a major currency pair must be traded freely, meaning no interference in the form of capital controls or government limits on inflows and outflows.

These products are not suitable for all clients, therefore please ensure you fully understand the risks and seek independent advice. When you place a trade on a currency pair, you’re essentially buying one currency and selling another – but in a single transaction. So for example, going long or ‘buying’ EUR/USD means you’re buying the euro and selling the US dollar. Going short means that you’re ‘selling’ the Euro and buying the US dollar. A currency pair is made of up to two currencies traded in the forex market. Remember that the forex market can be volatile and trading with leverage can greatly increase the chance of losses for traders.

The term Kiwi is in reference to the small, flightless, native bird in New Zealand, called the Kiwi bird. “The Chunnel” is a combination of the Euro and the British pound sterling, a play on words for the Channel Tunnel that connects both continents. This currency pair is typically seen as very strong, given the proximity of regions and their solid history of trade.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This is no different than in the Forex Exchange Market, where, instead of speculating the value of a commodity, the traders speculate the currency prices of one currency against another. When two currencies are quoted against each other and their values compared, they become a Currency Pair. In basic financial markets, the traders seek to profit by comparing the prices of different commodities. They then invest in the commodity that is more valuable and which will bring them the most profit. The spread offered to a retail customer with an account at a brokerage firm, rather than a large international forex market maker, is larger and varies between brokerages.

An Introduction to Forex Trading

The pair also displayed notable movements during 2020, when the Covid-19 pandemic all but shut down national economies across the UK and Europe. These three are the cross currency pairs with the most liquidity because they all contain a different combination of the traditional majors. The final commodity currency which appears on most major currency lists is the NZD/USD pair. This is the New Zealand dollar against the US dollar – otherwise known as the ‘kiwi’.

It is also the third most popular reserve currency , plus the fourth most traded currency. With the UK leaving the EU after Brexit in 2020, the Pound is unlikely to adopt the Euro any time soon. While there are EIGHT major currencies, there are only SEVEN major currency pairs.

What are the 7 major currency pairs?

- The euro and US dollar: EUR/USD.

- The US dollar and Japanese yen: USD/JPY.

- The British pound sterling and US dollar: GBP/USD.

- The US dollar and Swiss franc: USD/CHF.

- The Australian dollar and US dollar: AUD/USD.

- The US dollar and Canadian dollar: USD/CAD.

- The New Zealand dollar and US dollar: NZD/USD.

Investopedia does not include all offers available in the marketplace. FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET. Take control of your trading with powerful trading platforms and resources designed to give you an edge. When you buy one currency, you automatically sell another currency. Update it to the latest version or try another one for a safer, more comfortable and productive trading experience. FREE INVESTMENT BANKING COURSELearn the foundation of Investment banking, financial modeling, valuations and more.

This manageable number of choices makes trading a lot less complicated compared to dealing with equities, which has thousands of possible choices to choose from. The most common currency pairs often involve the US dollar or Euro, but may also show up among geographic neighbors like Australia and New Zealand. High volume also means that traders can enter and exit the market with ease, with large position sizes. In lower volume pairs it may be more difficult to sell or buy a large position without causing the price to move significantly. 74.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs. I understand that I may not be eligible to apply for an account with this FOREX.com offering, but I would like to continue. Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy.

Understanding major currency pairs

In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The most traded pairs of currencies in the world are called the Majors. They constitute the largest share of the foreign exchange market, about 85%, and therefore they exhibit high market liquidity. In forex, it’s based on the number of active traders buying and selling a specific currency pair and the volume being traded. Crosses that involve any of the major currencies are also known as ” minors”. When you trade in the forex market, you buy or sell in currency pairs.

How Are Prices of the Major Pairs Determined?

So, having explored the 6 Major Forex Currency Pairs, you should now be confident to be able to step into the Forex trading world and place your first Forex trade with Hantec Markets. BRICs was a term created by Goldman Sachs to name today’s new high-growth emerging economies. Regarding the FX market, there are four main CEE currencies to be aware of. So when paired with the U.S. dollar, USD/SEK is read “dollar stockie” and USD/NOK is read “dollar nockie”. This meant that these countries now had one currency, with the same monetary value, with the exception that each of these countries minted their own coins.

Some of the popular digital currencies are Ethereum, Bitcoin, and Litecoin. The U.S. Dollar is by far the most heavily traded currency being on 88 percent of all trades in 2019. Dollar by being on 32 percent of transactions, and the Japanese Yen is on 17 percent. Keep up to date with our news and analysis section of the website, which can provide insight and predictions into future movements in the forex market. In the forex exchange market, countries with the largest economy make up the MajorPairs, while those with low economy do not.

The first in the forex currency pair is always the base currency, whereas the second currency is the quote currency. Choose which currency pair you would like to trade, either from our most traded currency pairs list or a more exotic pair. The Japanese Yen is the third most traded currency globally and a popular reserve currency. The population of prime xtb Japan is around 40% of the US, its economy is relatively large. The Yen is seen as an ultimate safe-haven currency in times of global stresses. This is because of various factors, including the super low-interest rates in Japan since the 1990s, repatriation pressures from its positive net foreign asset position and historical, traditional reasons.

Minor currencies include the Mexican peso, Chinese yuan, South Korean won dollar, Swedish krone, Russian Ruble, Norwegian krone, Hong Kong dollar, Singapore dollar and Turkish lira. Most minor pairs have a very low share of total Forex trading volume. In case you hadn’t noticed, all of the above currency pairs include the US dollar, the world’s reserve currency. The foreign exchange market, commonly referred to as the forex market, is based on the trading of one currency for another.

These two currencies are referred to as ‘currency pairs’ and they’re made up of the base currency and the quote currency. When trading currencies, the difference in the price of a currency pair is where you’ll make your profit or loss. “The Cable” is a combination of the British pound sterling and the US dollar.