V3220 Interest Tax Shield

Content

One way to increase cash flow is by using tax shields to reduce the net income you report to the IRS and decrease your tax owed. In this article, we’ll go over why you should use tax shields and several types you can use now. It reduces the borrowers’ taxable income, and in turn, his or her tax liability. The interest that one pays on the student loan is tax-deductible. In the case of depreciation, the quantum of the amount eligible for tax shield may vary based on the depreciation method in use.

- Due to the tax-deductibility of interest expense, the weighted average cost of capital takes into account the tax reduction in its formula.

- Learn the formula used to calculate an annuity’s value, and understand the importance of labeling specific numbers to calculate an output over time.

- The best way to maximize the tax-saving benefits of tax shields is to take the “tax shield effect” into consideration in all business financial decisions.

- You shell out the full amount of the donation in cash and shield 21% of that amount from tax.

- This is done by allowing investor’s accelerated depreciation benefits so that it invests money in solar power projects or wind power.

- If you don’t need a $5,000 office computer, spending money and claiming depreciation may not be the right tax strategy.

Tax Shield FormulaTax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government. Depreciation tax shield is the reduction in tax liability that results from admissibility of depreciation expense as a deduction under tax laws. The example discussed above illustrates a depreciation tax shield. Section 179 allows you to write off the entire cost of a fixed asset the year of purchase rather than deducting it over time. Other methods spread out the deduction, but you claim more of it in the early years.

Financial Depreciation Vs Tax Depreciation

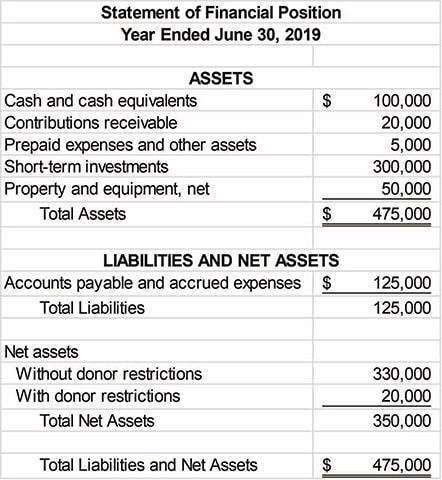

Those whose company offers an employer-sponsored plan, such as a 401 or 403, can make pretax contributions up to a maximum of $19,500 in 2020 ($19,000 in 2019). Compute the present value of interest tax shields generated by these debt issues.

Also, the interest expense is tax-deductible on the debt which makes the selection of debt funding cheaper. However, the company cannot raise the maximum funds from debt since it increases the financial risk. Therefore, based on it the deductions are explained whether legitimate or not. The value for the tax shield approach also depends on the corporation or individual effective tax rate. Also, there can be cases when the current year’s income can be reduced than the previous year due to unclaimed tax losses of the preceding year.

- These assets continue to be a part of the balance sheet unless they are sold or destroyed.

- Binomial distribution is a specific probability distribution which assigns occurrence probabilities to a random event’s outcome.

- Given the decreased taxable income, Company B’s taxes for the current period are approximately $6.5m, which is $840k lower than Company A’s $7.4m in taxes.

- You now know that maximizing tax-saving benefits using tax shields must play an essential role in every financial decision.

- Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting.

- When adding back a tax shield for certain formulas, such as free cash flow, it may not be as simple as adding back the full value of the tax shield.

- Here, Company A will carry no debt on its balance sheet , whereas Company B will have $4m in interest expense.

Consider the case where a firm is completely stupid and issues new debt at above the market value as it grows. Even though the company may raise debt of 17.5, its equity value has gone down by 35. The decline in value from growing and stupidly paying too much for debt each time you grow.

EBIT is a company’s net income before income tax expense and interest expenses have been deducted. EBIT is used to analyze the performance of a company’s core operations without the costs of the capital structure and tax expenses impacting profit. Deducting Debt Interest Because the interest that accrues on debt can be tax deductible, the actual cost of the borrowing is less than the stated rate of interest.

What Is A Tax Shield?

The EPS formula indicates a company’s ability to produce net profits for common shareholders. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. When a long-term asset is purchased, it should tax shield formula be capitalized instead of being expensed in the accounting period it is purchased in. In this lesson, you’ll learn the steps required to determine the value of a bond. You’ll also learn how to come up with an appropriate discount rate to use in the bond value calculation.

What is the tax shield quizlet?

What is the interest tax shield? The interest tax shield is the gain to investors from the tax deductibility of interest payments. It is the additional amount that a firm would have paid in taxes if it did not have leverage. Only $35.99/year.

This makes the debt to be even more expensive for the firm to service hence lowering the value of the business. Another restriction may be for a business to maintain various levels of ratios such as debt coverage ratio or debt-equity ratio. Secondly, there is an agreement attached to the debt that an individual or a business is supposed to adhere to. The agreement may include restrictions where a business needs to adhere to, to be able to obtain the debt. Such may include refraining from say, selling of business assets. The taxes saved due to the Interest Expense deductions are the Interest Tax Shield.

But once the interest expense is accounted for, the two companies’ financials begin to differ. Since Company A has no non-operating expenses to factor in, its taxable income remains at $35m. But since the WACC already factors this in, the calculation of unlevered free cash flow does NOT account for these tax savings – otherwise, you’d be double-counting the benefit.

Tax And Accounting

In the second column a traditional WACC capital structure is used after a tax change that creates a tax shield on interest. It is likely the observed equity beta has not changed and the estimated cost of equity would be similar . The problem with WACC method in the middle column is that if the nominal amount of debt is used , the enterprise value is over-stated. In addition the WACC is distorted because the percentages are applied to the nominal debt and not the market value of debt to the firm. McKinsey, Damoradan and other finance professors continue to confuse the issue.

This is not much of a problem when the Bu and Ku is established from a comparison set of companies. The remaining circular reference from re-levering the beta can be easily resolved. Tax is a cash expense and depreciation is a non-cash expense, therefore it is a real-time value of money-saving. It just depicts the utilization and benefit of the time value of the money to push tx expenses out as far as possible. Any size or nature of business whether small, medium or big can benefit from the approach. It boosts the value of the organisation by reducing taxpayer obligations.

Amended Tax Return What Is

Right now, the store can keep up with local demand, but Kelsey’s social media presence has massively increased the amount of online orders. Here are seven tax shields you can realistically take advantage of in your business. Here are a few reasons your business should take advantage of tax shields. For example, if you have depreciation of $100 and a tax rate of 21%, the tax your business is shielded from by the depreciation is $21. Don’t wait to the end of the year to do your tax planning; some deductions are pro-rated through the year, so you won’t get the maximum savings if you purchase late in the year. A tax shield also increases the value of a business, which is important if you want to sell your business or get loans and investors. The recent tax law changes have removed some tax deductions, particularly those on IRS Schedule A, like unreimbursed employee expenses.

Tax shield in the way of various forms involves in types of expenditure that is deductible from taxable income. This strategy can be used to increase the value of a business since it reduces the tax liability that would otherwise reduce the value of the entity’s assets. For tax purposes, a deductible is an expense that can be subtracted from adjusted gross income in order to reduce the total taxes owed. A mortgage interest deduction allows homeowners to deduct mortgage interest from taxable income. The modified adjusted gross income you report on your tax return is used to determine if you qualify for certain tax benefits. Neglecting the tax shield would be ignoring a very important benefit of borrowing that could potentially lead to a company being undervalued from the inflated cost of debt.

In other words, the tax shield protects part of the taxpayers income from being taxed. The tax shield benefits are determined by the overall tax rate as well as cash flow for a specific tax year.

How Does The New Tax Law Affect Tax Shields?

As shown below, the these formulas can start with computing the unlevered beta. But it is simply unforgivable that the beta on debt is so often assumed to be zero. Note that the Bu does not properly account for the reduction in economic leverage caused by the reduction in fixed obligations. Why these fancy professors and consultants cannot figure this out is stupifing. In valuation and finance texts including texts by Damarodan and the McKinsey Valuation book, various methods are typically described. Some of the most irritating discussion is in a HBS article that seems to promote the APV method as some sort of advanced method that better reflects management strategy. An example of discussion of different methods that say nothing about any underlying theory of how tax shields should be value is illustrated below.

After-Tax Return On Assets Definition – Investopedia

After-Tax Return On Assets Definition.

Posted: Sat, 25 Mar 2017 22:36:46 GMT [source]

Another requirement is that the asset must have an expected lifespan of over a year. The concept was originally added to the methodology proposed by Franco Modigliani and Merton Miller for the calculation of the weighted average cost of capital of a corporation. Higher the savings from the tax shield, the higher is the cash profit of the company. The extent of tax shield varies from nation to nation, and as such, their benefits also vary based on the overall tax rate. Bottom LineThe bottom line refers to the net earnings or profit a company generates from its business operations in a particular accounting period that appears at the end of the income statement. A company adopts strategies to reduce costs or raise income to improve its bottom line. The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible.

Is Tax Shield A Cash Flow?

Keep in mind we’re talking about tax avoidance, not tax evasion. Tax avoidance means using the existing rules to legally reduce your business’s taxable income and avoid certain taxes. Tax evasion is a form of fraud where you lie about your taxable income, and it’s illegal.

Also, there is a condition that the asset must be used to generate income in the business. Another can be that the assets should have an expected life of around a year.

If you expect the asset to stay usable for five years, you can deduct 20% a year; if it’s 20 years, you’d deduct 5% annually. For example, suppose you’re contemplating buying a $30,000 backhoe next year for your pipe-laying company. You have a lot of income in the current year, so you buy the backhoe in June of this year instead of waiting. That way, you can use six months’ worth of depreciation tax benefit to reduce this year’s income tax. S corporations and general partnerships are not taxed at the business level. Instead, income passes through to the owners and is taxed at their personal tax rate.

Learn the formula used to calculate an annuity’s value, and understand the importance of labeling specific numbers to calculate an output over time. Depreciation is one of the ways you can write off money your business spends on fixed assets such as buildings, computer equipment, furniture and vehicles. Every year of ownership, you get to deduct part of the purchase price as a taxable expense.

Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs.

Amortization is like depreciation for intangible assets, such as expensive software programs or the expenses to get a patent approved. By avoiding taxes, even if just in the short term, you allow your business to reinvest that cash flow to grow.

Learn to increase your cash flow by using tax shields to reduce net income. The Blueprint explains how your business can shield income from taxes. As you review tax shields, compare the value of tax shields from one year to the next. If your business has a higher income and a higher tax rate in one year, the amount of tax savings will be higher in that year.

How does the tax shield work?

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest, medical expenses, charitable donations, amortization, and depreciation. … Tax shields lower the overall amount of taxes owed by an individual taxpayer or a business.

Companies try to maximise their expense for depreciation to incorporate the tax filings. Moreover, they use different depreciation methods like the sum of years digits and double-declining balance method to lower taxes for recent years. Similarly, it plays an essential role in deciding the type of depreciation method that a company follows. However, this must be noted that the type of method only matters with the time value of money and no impact on the total amount over the useful life. Depreciation that a company charges on assets are also tax-deductible. The deduction applies to both tangible and non-tangible assets (software, patents, etc.). However, to get the deduction, the asset must be used in a business or helps business to generate income.

- Depreciation Tax ShieldThe Depreciation Tax Shield is the amount of tax saved as a result of deducting depreciation expense from taxable income.

- So, you could say that taking on debt has a tax benefit because you can use the interest as a tax-deductible expense.

- Instead, the value is depreciated over the useful life of the asset, and that expense is deducted on the tax return.

- This is because the rating of some deductions, such as depreciation happens throughout the year.

- A good tax professional can help you maximize tax shields and minimize taxes.

Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. After introducing valuation methods with different fancy titles things typically become even more irritating. You get all sorts of formulas that are just different versions of a WACC table that shows the percent of debt and equity.

Author: Edward Mendlowitz