What Happens If Bitcoin Succeeds?

The cryptocurrency’s protocol only allows new bitcoins to be created at a fixed rate, and that rate is designed to slow down over time. Thus, the supply of Bitcoin slowed from 6.9% in 2016 to 4.4% in 2017 and 4% in 2018. Just as for other commodities, the cost of production plays an important role in determining the price of bitcoin. According to research, bitcoin’s price in crypto markets is closely related to its marginal cost of production. The bitcoin enthusiasts are quite vague on what success means beyond rising prices, they seem more fond of arguments wrapped in mysticism than basic economic logic. The most important criterion for success is that cryptocurrencies end up being used in commercial transactions, like Tesla accepting bitcoin today. All the other value propositions, like their use in payment systems (Fatás and Weder di Mauro 2018) or their safe-haven role (Cheema et al. 2020), flow from that. If cryptocurrencies cannot be directly exchanged for real goods, they will not be very successful.

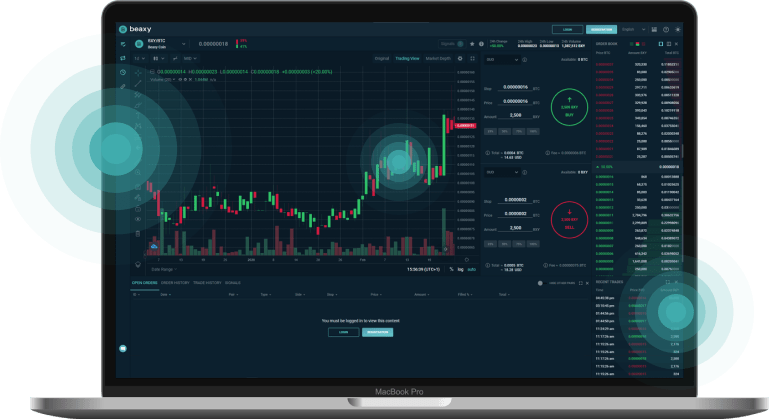

We have detected: #EthereumClassic $ETC was listed as ETC/BTC on #Beaxy

— Coinesium (@CoinesiumApp) December 27, 2021

Disappointed by the lack of clear resources on the impacts of inflation on economic indicators, Ian believes this website serves as a valuable public tool. This calculator is not realtime – try querying data for a previous month. Learn about altcoins, how they work, and which are the most popular. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from https://www.beaxy.com/ other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. In 2017, Bitcoin accounted for more than 80% of the overall market capitalization of crypto markets. According to estimates by some sites, electricity consumption for the bitcoin-mining process is equal to or more than that of entire countries. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

Bitcoin Price Chart, 2010

If then the bitcoin investors respond that everybody should buy bitcoin, all that accomplishes is to bid the price up even more, making existing bitcoin investors even more wealthy. Terra refers to an open-source blockchain protocol for stablecoins and apps, and is one of two main cryptocurrency tokens under this protocol. Bitcoin was released in the aftermath of a financial crisis precipitated by the loosening of regulations in the derivatives market. The cryptocurrency itself remains mostly unregulated and has garnered a reputation for its border- and regulation-free ecosystem. Purchasing a stock grants you ownership in a company, whereas purchasing a bitcoin grants you ownership of that cryptocurrency. So, a sharp increase in inequality is an inevitable consequence of bitcoin success. To begin with, the current owners of bitcoin will become the wealthiest people in the world, rivalling the kings and emperors that ruled over empires in centuries past. Compared to the multitudes that own assets today via all the pension funds and mutual funds and the rest, it is a tiny group of people. Ian Webster is an engineer and data expert based in San Mateo, California. He has worked for Google, NASA, and consulted for governments around the world on data pipelines and data analysis.

We have detected: #NEO $NEO was listed as NEO/BTC on #Beaxy

— Coinesium (@CoinesiumApp) December 27, 2021

Fortunately, the internal contradictions and perverse consequences of cryptocurrencies’ success mean that they are destined for failure. Until then, it might make sense for speculators to ride the cryptocurrency bubble, so long as they get out in time. The price of a single bitcoin is determined by several factors, including supply and demand, competition, and its regulation. News developments also influence investor perception about cryptocurrency. As mentioned earlier, regulatory news can move the cryptocurrency’s prices substantially. Hard and soft forks, which alter the number of bitcoins in existence, can also change investor perception of the cryptocurrency. For example, the forking of Bitcoin’s blockchain into Bitcoin Cash in August 2017 resulted in price volatility and spurred the valuation of both coins. The supply of an asset plays an important role in determining its price. A scarce asset is more likely to have high prices, whereas one that is available in plenty will have low prices.

What Happens If Bitcoin Succeeds?

Success means it is used in transactions, but that requires bitcoin becoming a unit of account, and for that to happen, the purchasing power of a bitcoin must stabilise. As bitcoin starts displacing fiat money more and more, it will change society in profound ways. Those who own assets and services they can sell to the bitcoin aristocrats will prosper. Someone has to build their houses and clean their toilets, educate their children and cook their food. The only reason all the bitcoins are worth a trillion dollars is the expectation of success, as they are not very useful today. The decline in supply corresponds to increasing demand due to news media coverage and its price volatility. A combination of shrinking supply with a boost in demand has resulted in surging bitcoin prices. Bitcoin’s governance policies, which are set by a group of core developers, also affect its price. It is also popular with criminals who use it to transfer large sums of money for illicit activities. Finally, investor demand for the cryptocurrency has also risen with increased media coverage.

For example, China’s citizens may have reportedly used the cryptocurrency to circumvent capital controls in 2020. Bitcoin has also become popular in countries with high inflation and devalued currencies, such as Venezuela. For example, China’s moves to ban bitcoin trading and limit operations of bitcoin-mining infrastructure affect the cryptocurrency’s supply and demand. The main reason for bitcoin usd this was an increase in awareness of and capabilities for alternative coins. For example, Ethereum’s Ether has emerged as a formidable competitor to Bitcoin because of a boom in decentralized finance tokens. Investors who see its potential in reinventing the rails of modern financial infrastructure have invested in ether, the cryptocurrency used as “gas” for transactions on its network.

What Determines The Price Of 1 Bitcoin?

Breaking down everything you need to know about Bitcoin mining, from blockchain and block rewards to proof of work and mining pools. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Since Bitcoin’s introduction in 2009, its bitcoin supply has been diminishing. Andrew Bloomenthal has 20+ years of editorial experience as a financial journalist and as a financial services marketing writer. If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices.

- That means its price is determined by a complex combination of factors that include production costs, competition, and regulatory developments.

- The only reason all the bitcoins are worth a trillion dollars is the expectation of success, as they are not very useful today.

- It is also popular with criminals who use it to transfer large sums of money for illicit activities.

- Fortunately, the internal contradictions and perverse consequences of cryptocurrencies’ success mean that they are destined for failure.

- For example, if you purchased 100 coins at $65.52 on July 5, 2013, and held it until its all-time high of $68,790 on Nov. 10, 2021, you would have $6,872,448.

On Oct. 13, 2021, Ethereum accounted for almost 18% of the overall market cap of cryptocurrency markets. All of this means that shrinkage in supply has coupled with a surge in demand, acting as fuel for bitcoin prices. Alternating periods of booms and busts have become a feature of the cryptocurrency ecosystem. For example, a run-up in bitcoin’s prices in 2017 was succeeded by a prolonged winter. In other words, the value proposition for bitcoin is that it will displace fiat money – the dollar, euro, renminbi and all the others – either fully or partially. As I argue below, I think it is inevitable that it will be ‘either, or’ – either full displacement or no displacement, complete success or failure. And as I said here on Vox three years ago , I don’t think cryptocurrencies make sense. An indirect cost of bitcoin mining is the difficulty level of its algorithm. The varying difficulty levels of bitcoin’s algorithms can hasten or slow down the rate of bitcoin production and affect its overall supply, thereby affecting its price.

What Determines Bitcoins Price?

Though Bitcoin is the most well-known cryptocurrency, hundreds of other tokens are vying for crypto investment dollars. Bitcoin is a cryptocurrency developed in 2009 by Satoshi Nakamoto, the name given to the unknown creator of this virtual currency. Transactions are recorded in a blockchain, which shows the transaction history for each unit and proves ownership. To the vast majority of bitcoin investors, success means its price continues to rise. But if that is all there is to it, someday a little boy will yell, “the Emperor has no clothes”, and the price will come crashing down. According to research, bitcoin market price is closely related to its marginal cost of production. Arriving at a solution to the problem requires brute force in the form of considerable processing power. In monetary terms, this means the miner will have to spend money on racking mining machines equipped with expensive processors. Bitcoin halving events, which occur every four years, generally correspond to a significant bump in its prices because it means that the cryptocurrency’s supply has been reduced.

Unlike investing in traditional currencies, Bitcoin is not issued by a central bank or backed by a government. And buying a bitcoin is different from purchasing a stock or bond, because Bitcoin is not a corporation. Consequently, there are no corporate balance sheets or Form 10-Ks to review. And that contradiction may be the reason why bitcoin cannot become successful.

She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. This is why I think coexistence between bitcoin and fiat would be an unstable equilibrium. If bitcoin becomes successful, then we will want to use it more and more. That makes it even more successful so that we disregard fiat even more. In the end, fiat will be fully displaced, as the success of bitcoin becomes a self-fulfilling prophecy . But the perverse consequence of this is that as bitcoin continues its ascendance, the less fiat will be worth. A cryptocurrency is a digital or virtual currency that uses cryptography and is difficult to counterfeit.